General Economic Update

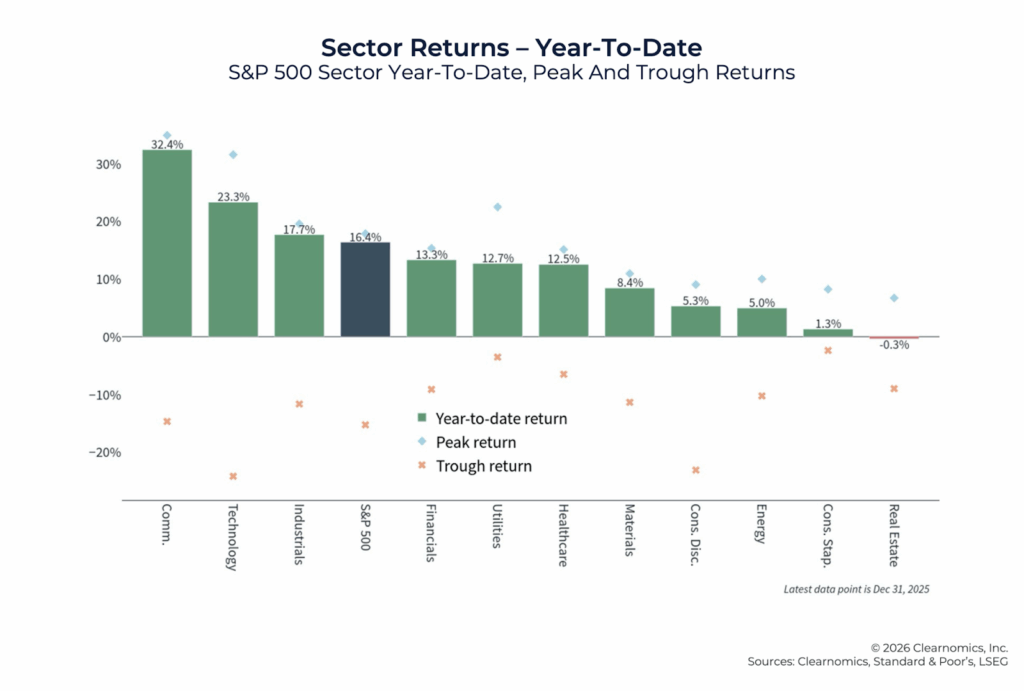

December delivered only small gains in the U.S., while many non‑U.S. markets ticked a bit higher. Even so, we ended 2025 just shy of record highs. It was the third straight year of double‑digit returns for U.S. stocks – another sign of this market’s resilience despite plenty of headwinds. AI continued to be a powerful theme with companies tied to AI spending – especially data center buildouts – helping to lift stocks in 2025.

We’re also seeing a K‑shaped economy that is creating different realities for higher‑income and lower‑income Americans. Rising U.S. stock market prices supported confidence and spending among higher‑income households. At the same time, increasing living expenses on already‑stretched incomes and disruptions to some government benefits weighed on lower‑income families. That was 2025’s pattern: strong headline numbers, but not everyone participated equally.

The Federal Reserve cut interest rates three times in 2025 starting in September 2025 bringing the fed funds target range down to roughly 3.50%–3.75% by year‑end. Policymakers signaled a cautious path forward for 2026.

Strong corporate earnings – especially in technology – offset broader economic worries and kept investors steady. Markets rose even without perfect conditions, showing how a company’s earnings strength can support market prices. Still, few market leaders and elevated stock prices could suggest some twists ahead. As conditions evolve, maintaining diversification – across international markets and U.S. companies beyond the “Magnificent 7” (top 7 stocks) – remains important as conditions evolve.

Market Update

Stock markets ended 2025 on solid footing. Gains were broad across asset classes by year‑end, with international stocks and gold among the standouts. Notably, 2025 marked the first time in roughly 15 years that non‑U.S. markets outperformed U.S. markets, highlighting the value of investing outside the United States. At the same time, US stock leadership remained concentrated in AI‑linked names. Expect occasional volatility as markets digest policy moves, labor data, and the sustainability of earnings growth.

Beneath the surface, labor signals deserve attention. Some cyclical areas (like construction) cooled, and certain AI‑adjacent white‑collar employers increased layoffs. Government hiring may not provide its usual offset, raising the risk of uneven payroll growth. No single indicator calls a recession, but together they warrant attention. With high stock valuations, any pressures on company earnings could amplify market swings.

Current Market Trends and Challenges

- AI continues to dominate spending, potentially totaling trillions more, but power and electrical infrastructure could become bottlenecks.

- Large‑cap tech earnings growth powered much of 2025’s returns, helping markets push through policy uncertainty.

- International equities led for the first time since 2006, a reminder that top market categories constantly rotate and diversification matters.

- Markets can rise even when conditions aren’t perfect, but with few companies making the bulk of the gains this raises the stakes if overall sentiment turns or their earnings disappoint.

- Geopolitical uncertainty and crowded trades may make for a choppier 2026, even if the primary trend remains positive.

Bonds as a Diversifier

For the better part of two decades, bonds reliably diversified against stock risk. That changed in 2021 when inflation spiked, leading to one of bonds’ toughest years in decades. The backdrop is shifting again as inflation cools toward the 2.5%–3.0% range and becomes less volatile. With the Fed beginning to lower interest rates, high‑quality bonds are regaining their role as a portfolio stabilizer. This environment supports keeping bonds in the mix to help smooth out stock market swings.

The Importance of Staying Invested

Markets can vary widely year to year, but patience and diversification have historically been rewarded.

- Since 1928, the S&P 500’s average total return is about 11.8%, with a typical one‑year “range” around −7.7% to +31.3%.

- Up years average roughly +21%; down years average about −13%.

- Despite average intra‑year drawdowns near 14% since 1980, annual returns were positive about 75% of the time.

- Analyst earnings per share estimates (excluding major shock years) tend to land reasonably close, reinforcing that company earning power drives long‑term stock value.

What This Means for Your Portfolio

- Stay balanced by favoring diversified stock exposure across styles, sectors, and regions- recognizing top stock gains could move beyond mega‑cap tech.

- Use bonds intentionally. High‑quality bonds look more attractive again as interest rates decrease and growth cools.

- Stick to your plan. Stay invested, rebalance thoughtfully, and avoid headline‑driven moves. These are the keys to compounding your investment returns over time.

- Align with you. Keep portfolio decisions tied to your goals, time horizon, and ability to take risks.

Resources

- Manning & Napier, Perspective (November 2025): https://www.manning-napier.com/insights/november-2025-perspective

- Hussman Funds, Market Comment (November 19, 2025): https://www.hussmanfunds.com/research/rs251119/

- TKer (Joe Fahmy/TK), “One-year stock market stats for investors”: https://www.tker.co/p/one-year-stock-market-stats-for-investors

- BlackRock, “AI, stocks, alternatives, and the new market playbook for 2026”: https://www.blackrock.com/us/financial-professionals/insights/ai-stocks-alternatives-and-the-new-market-playbook-for-2026

- BlackRock, “Bonds offer more diversification”: https://www.blackrock.com/us/financial-professionals/insights/bonds-offer-more-diversification

AFT Financial Planning LLC (“AFT Planning”) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The views expressed are as of January 2026 and are based on current economic conditions, which are subject to change. Statements of future expectations and other forward-looking statements that are based on current market and economic conditions and assumptions involve uncertainties that could cause actual results, performance, or events to substantially differ.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, AFT Financial Planning LLC (referred to as “AFT Planning”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute AFT Planning’s judgement as of the date of this communication and are subject to change without notice. AFT Planning does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall AFT Planning be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if AFT Planning or a AFT Planning authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

View comments

+ Leave a comment