The previous quarter saw strong momentum in U.S. stocks and a surprising decrease in bond prices (with yields increasing) despite Federal Reserve interest rate cuts. There are many ongoing questions about the future direction of the market. Here’s a breakdown:

Overall Market Update

- Current Market Trends and Challenges

- The S&P 500 (comprising the biggest 500 public companies) gained 25% in 2024, marking two consecutive years of over 20% growth—the first time since 1998–99.

- U.S. stock markets proved unusually resilient, recovering quickly after downturns, even during election uncertainties and interest rate changes.

- Growth stocks outperformed value stocks, with international markets lagging behind the U.S. slightly. Emerging markets faced challenges, particularly in China, where stimulus efforts have yet to show meaningful results.

- Interest Rates and Inflation

- The Federal Reserve cut interest rates three times in 2024, totaling a full percentage point by year-end.

- Despite rate cuts, the 10-year U.S. Treasury yield rose above 4.5% (with a decline in bond prices), highlighting mixed signals in the bond market.

- Inflation eased significantly, with core inflation at 3.3% by November, its lowest in years, as the labor market remained strong.

- Election Impact on Markets

- Markets rallied after the U.S. presidential election, with reduced volatility and overall strong performance.

- History shows markets trend higher regardless of political outcomes, reaffirming the importance of staying invested through uncertainties.

The Importance of Staying Invested

Why Timing the Market Is Risky

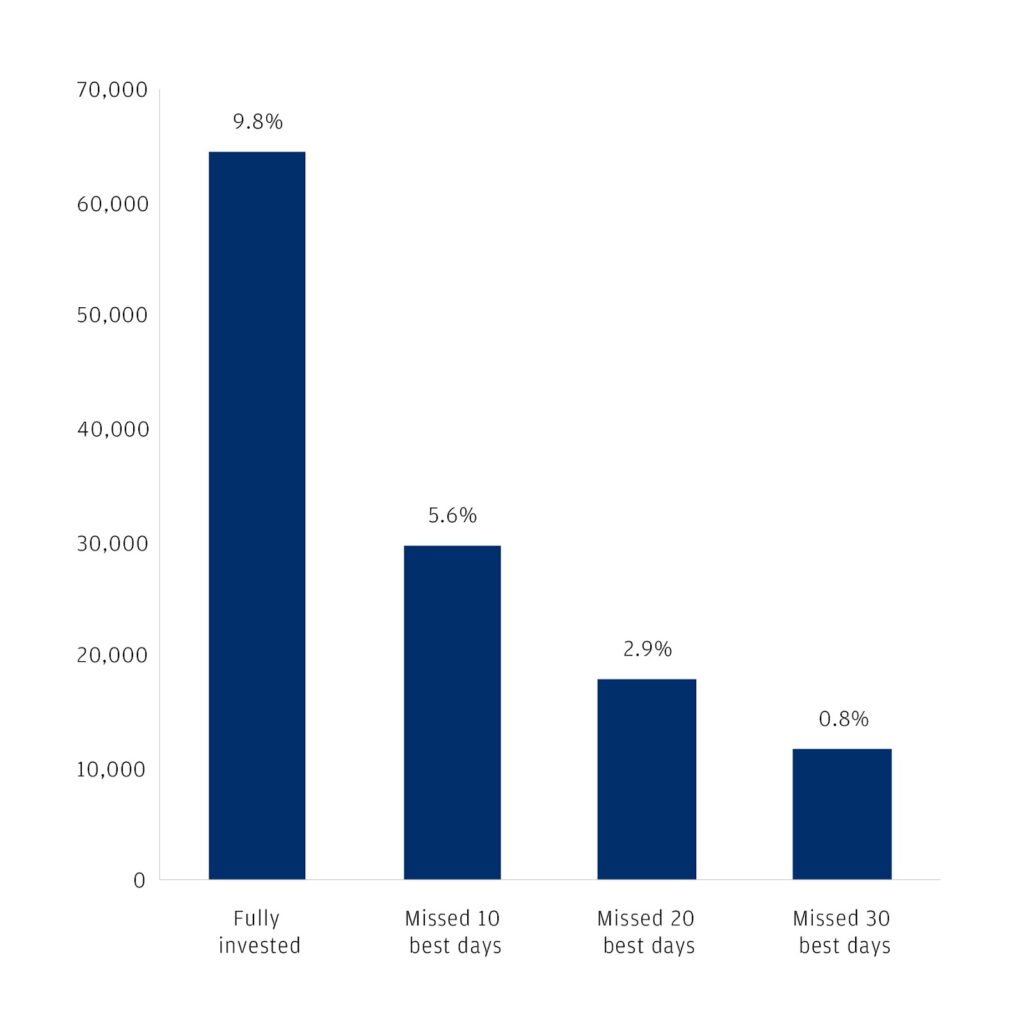

- Missing just the 10 best market days over the last 20 years could reduce a portfolio’s value by more than half.

- Many of the best days are closely followed by the worst days making it difficult (and nearly impossible) to time the market effectively.

- Staying invested ensures you’re positioned for long-term growth and avoids costly emotional decisions during volatile periods.

Source: J.P. Morgan Asset Management analysis using data from Morningstar Direct. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Analysis is based on the J.P. Morgan Guide to Retirement. Data as of February 1, 2024.

Resilience of the Market

Remember that the market reflects the innovation of companies solving real-world problems – even in challenging times. By staying diversified and ensuring your portfolio aligns with your risk tolerance, you can better navigate uncertainty and remain focused on achieving your financial goals. This disciplined approach helps you stay resilient through market fluctuations and positioned for long-term growth.

Looking Ahead

As we enter 2025, the economic outlook currently remains positive, with a strong labor market, easing inflation, and recent interest rate cuts suggesting continued market growth. While uncertainties around domestic and international policies, taxes, and trade persist, maintaining a diversified and disciplined approach can help you stay on course toward your financial goals.

In times of uncertainty, it’s essential to tune out emotionally charged headlines and focus on your long-term financial plan. A well-crafted strategy with clear goals and an aligned investment portfolio provides the foundation for progress, even in volatile markets. If you have questions about your portfolio, feel uncertain about your progress, or want to make adjustments for the new year, I’m here to guide and support you.

Sources:

- https://www.dimensional.com/us-en/insights/market-review-2024-stocks-overcome-uncertainty-to-notch-another-strong-year

- https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/the-five-most-popular-investing-mistakes-of-2024

- https://howardcm.com/index.php/2024/12/30/trend-spotting-2025-the-hcm-buyline-says-go-long/

AFT Financial Planning LLC (“AFT Planning”) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, AFT Financial Planning LLC (referred to as “AFT Planning”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute AFT Planning’s judgement as of the date of this communication and are subject to change without notice. AFT Planning does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall AFT Planning be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if AFT Planning or a AFT Planning authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

View comments

+ Leave a comment