Federal Reserve Cuts Rates

The Federal Reserve made a significant move in August, cutting interest rates by 0.5%. This decision, combined with the continued strength of the economy and declining inflation, suggests a shift towards a more neutral interest rate (where the Federal Funds rate is in line with the inflation rate). Historically, rate cuts often preceded economic downturns and market declines. However, the current economic situation suggests a more positive outlook.

Economic Data Remains Resilient

Despite some softening in the labor market, the US economy continues to demonstrate strength, primarily driven by consumer spending. While inflation has been on a downward trajectory, the Federal Reserve will likely focus more on the unemployment rate to determine future interest rate adjustments.

Market Outlook

The market has experienced both short-term ups and downs, but overall, it has shown resilience. Earnings for companies outside of the ‘Magnificent 7’ have started to pick up. This creates investment opportunities in a wider variety of assets. However, there could be underlying risks, including a potential economic slowdown and political uncertainty. To navigate this environment, it’s crucial to focus on managing risk while maintaining a diversified portfolio.

Key Economic Indicators

- US Bond Markets: Bond yields have been on the rise, reflecting concerns about the economy.

- US Debt Ceiling: The government’s credit rating was previously downgraded due to concerns about deficits and the debt ceiling.

- Interest Rates: Despite a recent rate cut, the Federal Reserve is expected to maintain elevated interest rates to combat inflation.

- Labor Market: The job market is showing signs of cooling, but unemployment remains relatively low.

- Equity Markets: Stocks have generally performed well this year, but there have been periods of volatility.

Outlook and Considerations

The economy continues to show strength, but there are risks ahead. It’s essential to stay informed and adjust your investment strategy accordingly. Maintaining a diversified portfolio can help mitigate risk and potentially capture opportunities.

A(nother) Quick Note About The Election

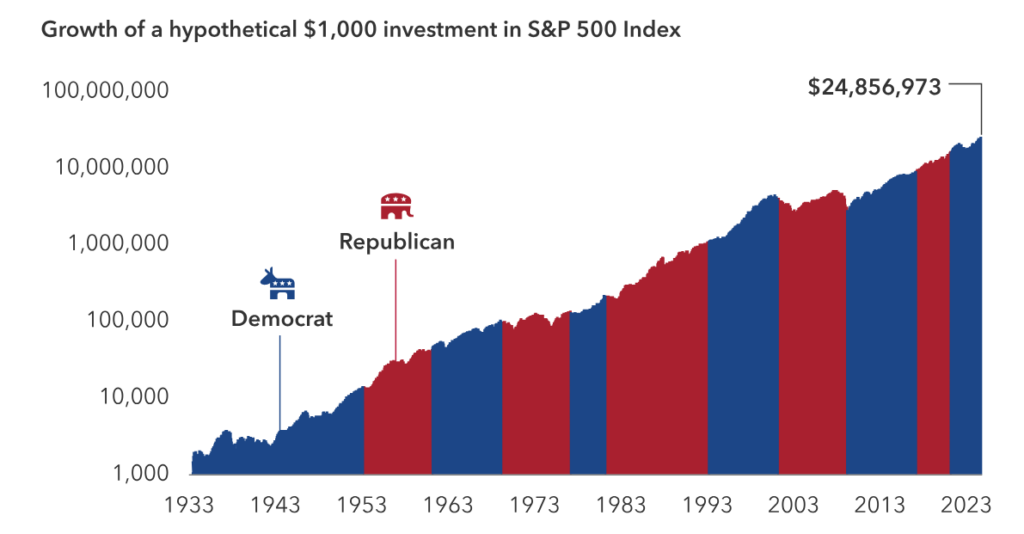

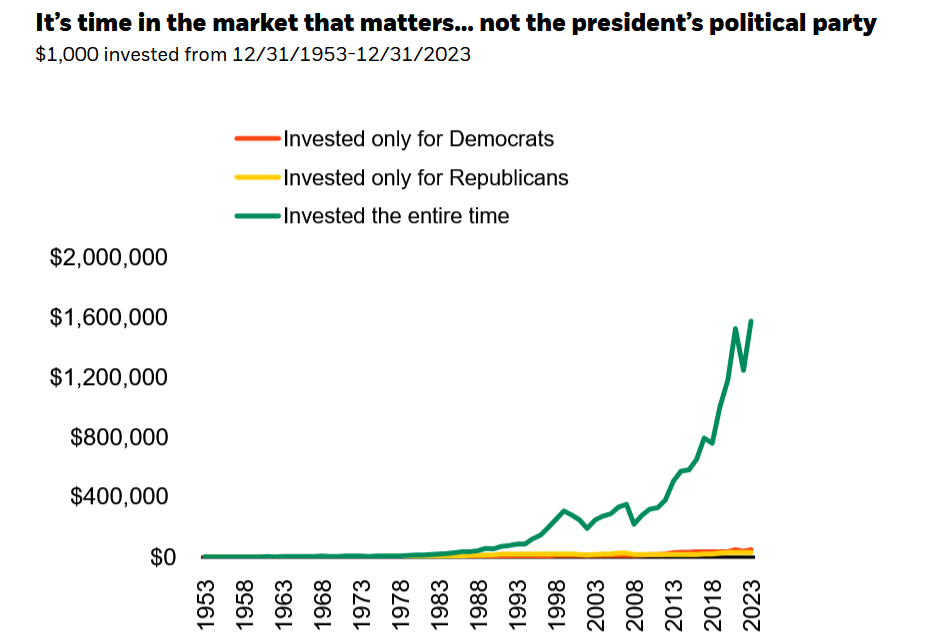

While we’re all aware of the upcoming election and its potential impact on the markets, it’s important to maintain a long-term perspective. According to research from Capital Group, historical data shows that the stock market has consistently trended upward over time, regardless of which party controls the White House or Congress.

Sources: Capital Group, RIMES, Standard & Poor’s. Chart shows the growth of a hypothetical $1,000 investment made on March 4, 1933 (the date of Franklin D. Roosevelt’s first inauguration) through June 30, 2024. Dates of party control are based on inauguration dates. Values are based on total returns in USD. Shown on a logarithmic scale. Past results are not predictive of results in future periods.

Source: Morningstar as of 12/31/23. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

It’s important to ignore the daily, emotionally charged headlines and prioritize long-term market performance. A well-crafted financial plan with defined goals and an aligned investment portfolio can help move closer towards your financial objectives. If you’re feeling uncertain about the market, your portfolio, or your progress, please contact us about how we can provide guidance and support.

https://aftplanning.com/contact

Sources:

- https://www.blackrock.com/us/financial-professionals/insights/investing-in-election-years

- https://www.capitalgroup.com/ria/insights/articles/how-elections-move-markets-in-5.html

The views expressed are as of October 2024 and are based on current economic conditions, which are subject to change. Statements of future expectations and other forward-looking statements that are based on current market and economic conditions and assumptions involve uncertainties that could cause actual results, performance, or events to substantially differ.

The material discussed is meant to provide general information and should not be construed as specific investment advice. Keep in mind that current and historical facts may not be indicative of future results. All investing involves risk, including the potential for loss of principal.

View comments

+ Leave a comment